Mastering Your Monthly Budget: Tips and Tricks

Unlock the secrets to mastering your monthly budget with practical tips and tricks to help you save money, reduce debt, and achieve financial freedom.

Understanding Your Income and Expenses

Mastering your monthly budget starts with a clear understanding of your income and expenses. Begin by listing all sources of income, including your salary, freelance work, or any side gigs. Next, categorize your expenses into fixed costs like rent, utilities, and insurance, and variable costs such as groceries, entertainment, and dining out. This comprehensive overview will help you see where your money is going and identify areas for potential savings. Remember, the key to a successful budget is accuracy, so be meticulous in tracking every penny. Financial awareness is the first step toward achieving your budgeting goals.

Setting Realistic Financial Goals

Once you have a clear picture of your income and expenses, the next step is to set realistic financial goals. These goals can be short-term, like saving for a vacation, or long-term, such as building an emergency fund or planning for retirement. Having specific, measurable goals will give you a clear target to aim for and keep you motivated. Break down your goals into manageable steps and allocate a portion of your income towards achieving them each month. By setting and working towards these goals, you'll be more likely to stick to your budget and make meaningful progress towards your financial aspirations.

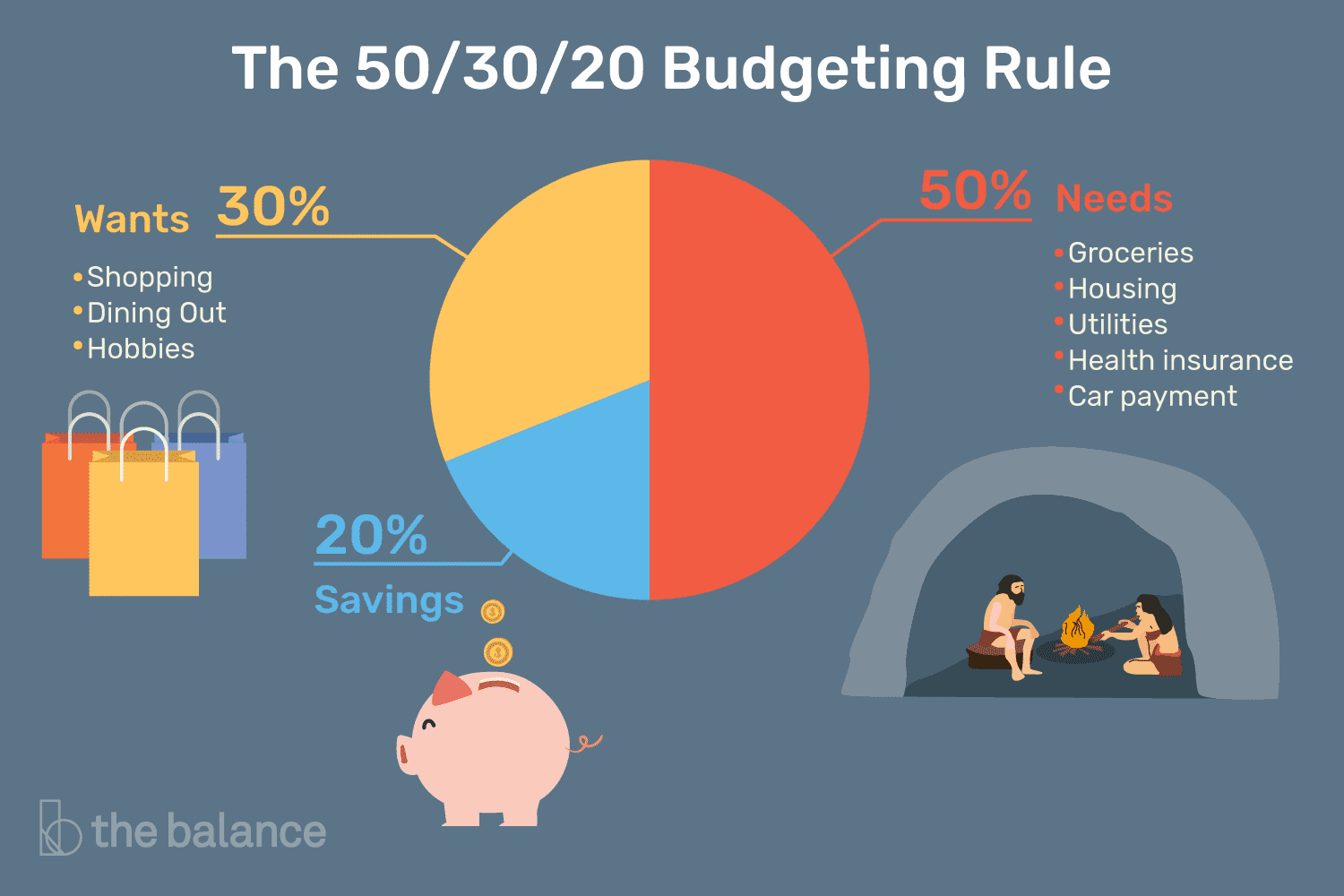

Creating a Spending Plan

A spending plan is essentially a roadmap for your finances. It outlines how much you plan to spend in various categories each month, based on your income and expenses. Start by prioritizing essential expenses, such as housing, utilities, and groceries. Then allocate funds for discretionary spending, like entertainment and dining out. Be sure to leave room for savings and unexpected expenses. A well-thought-out spending plan can help you avoid overspending and ensure that your money is being used in alignment with your financial goals. Regularly reviewing and adjusting your spending plan will keep you on track and help you adapt to any changes in your financial situation.

Tracking Your Spending

Tracking your spending is crucial for staying on top of your budget. Use tools like budgeting apps, spreadsheets, or even a simple notebook to record every expense. By consistently monitoring your spending, you'll be able to identify patterns and make adjustments as needed. For example, if you notice that you're consistently overspending on dining out, you can set a limit for that category and find ways to cut back. Keeping a close eye on your spending will help you stay accountable and make informed decisions about your finances. Remember, small adjustments can lead to significant savings over time.

Cutting Unnecessary Expenses

To master your monthly budget, it's essential to identify and cut unnecessary expenses. Start by reviewing your spending habits and looking for areas where you can reduce costs. This might include canceling unused subscriptions, cooking at home instead of dining out, or finding more affordable alternatives for entertainment. Additionally, consider negotiating bills like your phone or internet service to get better rates. Cutting back on non-essential expenses doesn't mean you have to sacrifice enjoyment; it's about making smarter choices that align with your financial goals. By eliminating wasteful spending, you'll free up more money to save or invest in things that truly matter to you.

Building an Emergency Fund

An emergency fund is a crucial component of a solid financial plan. It provides a safety net for unexpected expenses, such as medical bills, car repairs, or job loss. Aim to save at least three to six months' worth of living expenses in a separate, easily accessible account. Start by setting aside a small portion of your income each month and gradually build up your fund. Having an emergency fund will give you peace of mind and financial stability, allowing you to handle unforeseen circumstances without derailing your budget. Remember, the goal is to be prepared for the unexpected, so prioritize building and maintaining your emergency fund as part of your overall budgeting strategy.